In today's dynamic business landscape, small and medium-sized businesses (SMBs) are the driving force behind economic growth...

Who we are ?

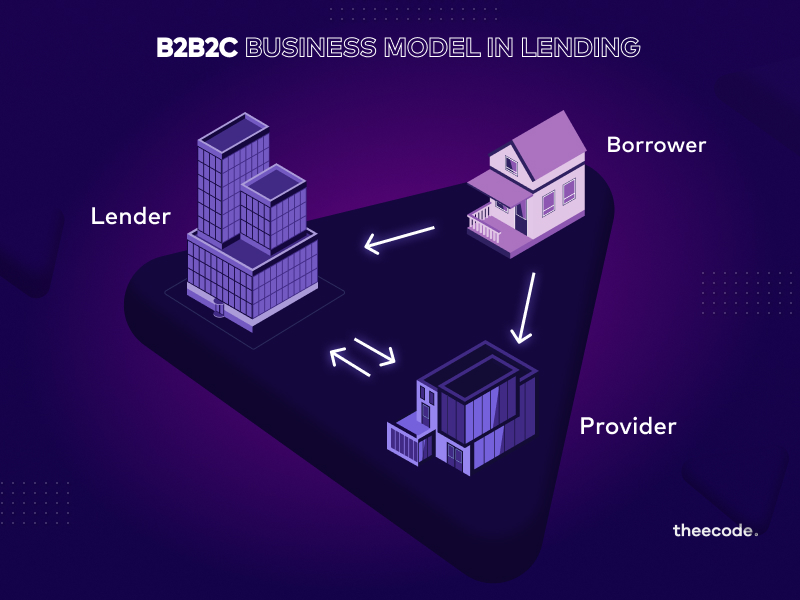

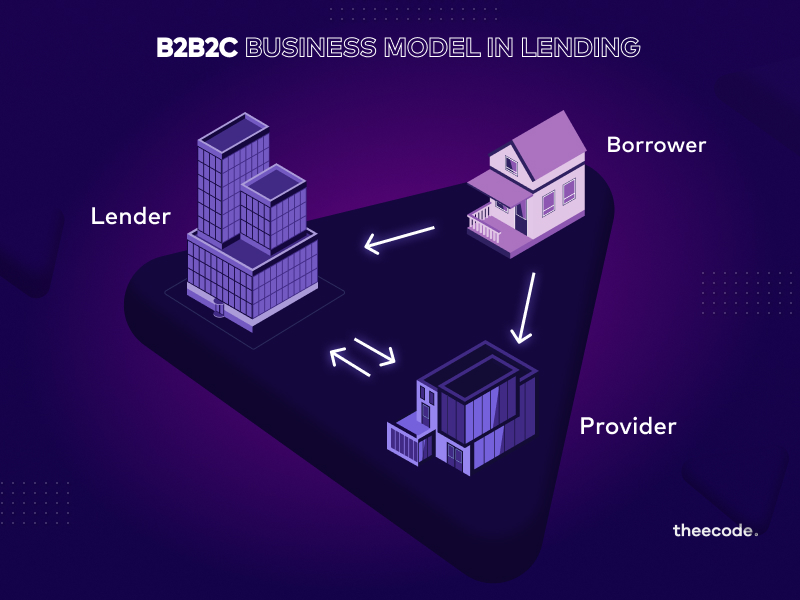

We envisioned to create a Global Fintech Ecosystem with Plug and Play architecture that would enable Lenders and Banks to easily offer financial services to the underbanked and unbanked, irrespective of their geo location.

Services

Revolutionize your lending experience with Theecode's innovative solutions

Loan Origination System

Our Loan Origination System (LOS) is extremely efficient and easy to use, providing a seamless experience for Digital borrowers and Dealers.As a financial institution or service provider, using our LOS sets you apart from the competition. Our LOS improves efficiency, simplifies processes, and speeds up response times throughout the loan origination cycle, including loan applications, underwriting, decisions, and loan funding. We don't just provide a basic solution, but we offer a customizable LOS tailored to your specific needs. Your institution is unique, and with our various customization options, you can explore new possibilities in Digital Lending world.

Key features:

AI-Powered Decision Engine

Our AI-powered Decision Engine, which is a rules-driven automation platform, utilizes vertical specific algorithms and rules defined by the lender to make decisions based on the borrower's criteria. It streamlines the decision-making process and can be tailored to fit the unique needs of the business. The engine analyzes data from various sources such as credit bureau reports, bank statements, expense reports, SMS data, accounting software, credit scores, identity verification, and income data, to ensure accurate and conclusive approvals or denials. The system also incorporates a human element to further enhance the decision-making process and gives complete control over the standards that must be met for approvals. This enables us to efficiently and quickly complete the hours-long process of verification and eligibility in a fraction of a minute.

Key features:

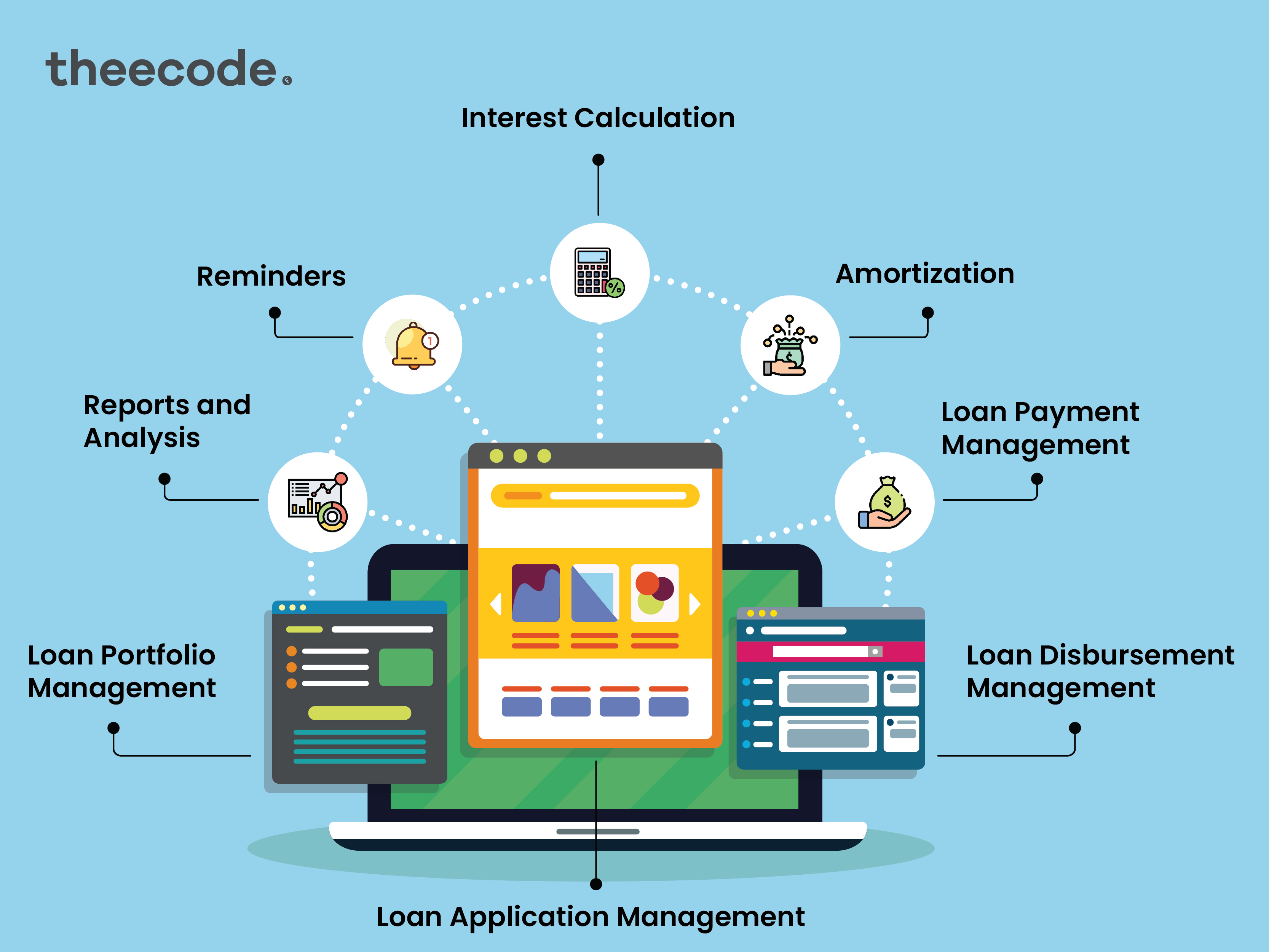

Loan Management System (LMS)

Our Loan Management System (LMS) offers a user-friendly interface for lenders to manage complete loan life cycle i.e, origination, serving the borrowers and ensures timely collection as per repayment schedule. The system is designed for efficiency, with a focus on error-free operation and robust security of data & documents. Additionally, our LMS is highly customizable to meet specific business needs. Our LMS offers centralized access with multiple communication channels like email, SMS, WhatsApp etc, and an admin dashboard as well as role centric dashboard for various roles within the organization. Our Loan Management System (LMS) provides comprehensive reports Track loan applications, re-verify credit worthiness of borrower, loan disbursement, processing fees and interest rates, collaterals (in case of auto loan GPS is used) and repayment calendar. These reports can be generated for individual borrowers and dealers, and evaluate the performance of the merchant and product offered.The system's reporting feature allows for easy visualization and understanding of the direction of the business.

Key features:

Solutions

Theecode provides vertical SaaS lending solutions for three key verticals

.5m+

Borrowers

30s

Each Approval

100+

E-Commerce Sites

900+

Satisfied Customers

Insights

Thoughts from our blog and important press releases

Running a successful business is no easy feat, and there are many factors that can hinder its success. In the lending industry, ...

The lending process may seem simple on the surface - a borrower requests a loan, undergoes...

Read More

In the current decade, technology has become an integral part of...

Read More

In recent years, digital payment adoption has become a global phenomenon, prompting countries and states to strive for ...

Read More

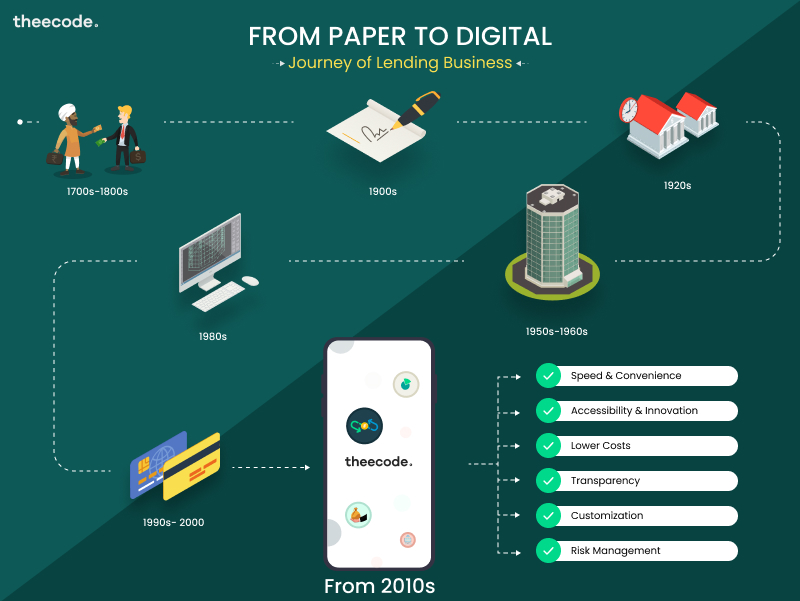

The lending business has come a long way from paper-based processes to digital lending platforms. In the past, getting a loan was...

Read More

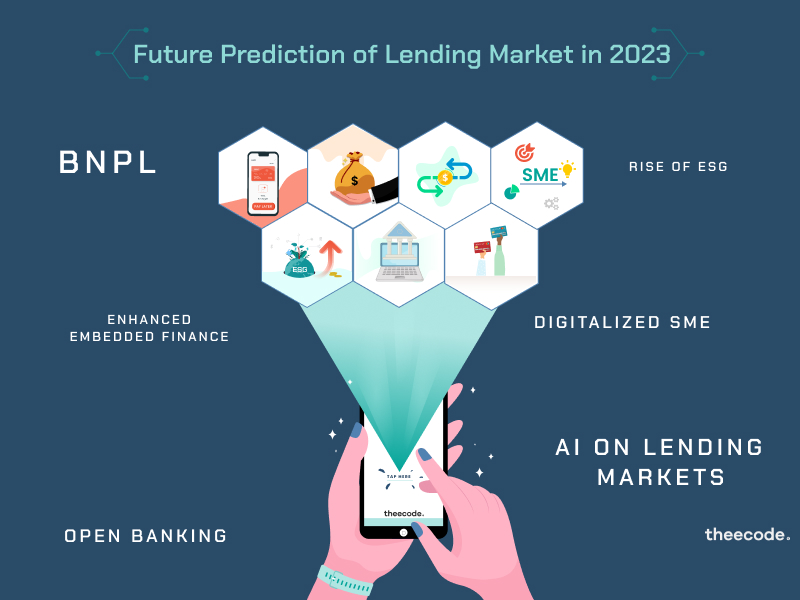

With the arrival of a new year, it's time to reflect on the past and anticipate the future of the lending market in the fintech industry. The industry is...

Read More

The concept of finance and technology was introduced to the world years ago and it has been booming since then...

Read More

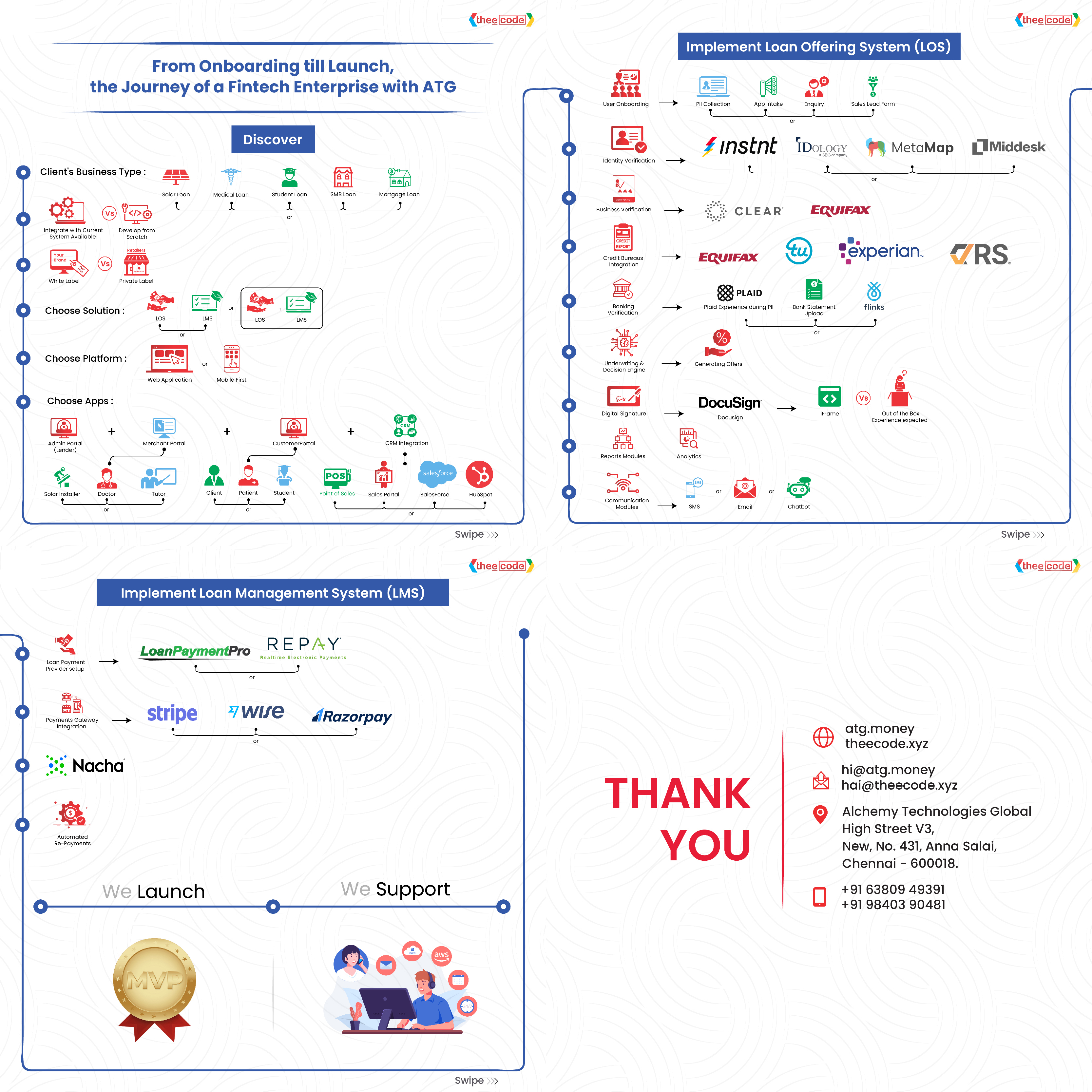

How at ATG (Alchemy Technologies Global) we enable our Clients from Initiation to Execution...

Read More© Copyright 2023 Theecode Technologies Pvt Ltd . All Rights Reserved